Date: May 14, 2019

Author: Paul Cockshott

In corresponding with readers it has become clear that in TNS we did not perhaps do a good enough job of explaining the relative roles of input-output techniques and the Harmony planning technique which we proposed. The input-output method is defined in terms of flows. If you look at an input-output table everything is a flow per year of product Y into the production process of industry X.

This corresponds to the idealised model that Marxist economists like Morishima developed to define labour values. An input-output table is thus a precondition to being able to compute labour values.

Now if you think back to the way the labour theory of value was defined and defended by Ricardo, it applies to freely reproducible commodities. The labour values defined by Morishima are likewise predicated on free reproducibility, he assumes that you can adjust the intensities of operation of individual industries so long as the result does not cause any product to have a net negative production and that the total labour use does not exceed the workforce available.

Most importantly, both the input-output formalism and labour values ignore constraints that are imposed by existing stocks of capital goods ( long-lived means of production ). As a flow formalism, long-lived means of production like ships or trucks only appear in the table in the form of the flow of replacement trucks or ships needed to sustain the existing productive capacity – material depreciation and its replacement.

Labour values, calculated on this basis, express the long run equilibrium social cost of making something, because in the long run, once capital stocks have been adjusted, everything is reproducible by labour – direct or indirect. But when changing the structure of the economy, in addition to labour you need to adjust the actual capital stocks available to you, and the existing stocks this year constrain what you are able to produce next year. Long term planning has to be able to take this sort of stock constraint into account. One, albeit short term, the approach is to use linear programming as Kantorovich did and to derive from this a set of what he termed Objective Valuations, which, over the short term will diverge from labour values. Kantorovich held that his Objective Valuations, would in the long term converge on labour values, but that in the short run they were useful to ensure that the best use was made of currently available plant and equipment.

I arrived at the Harmony approach whilst thinking over how to come up with a better algorithm for solving Kantorovich’s problem. As it happens I was in Budapest in 89 looking to find a Hungarian publisher/translator for the work the later became Towards a New Socialism and came across a Hungarian planning text in English and thinking about it whilst in a concert, I thought of an improved algorithm.

It should, therefore, be thought of as filling the same role as linear programming in the Soviet optimal planning school, but with better algorithmic performance.

To use the Harmony algorithm or Kantorovich’s method you need additional information not provided in the input-output formalism. Consider first the problem of constructing a single year plan. You need

1) a flow matrix or flow I/O table

2) a corresponding capital stock matrix, specifying the amount of machine Y needed to produce an annual flow of P of output x.

3) a depreciation matrix specifying how fast each type of capital good depreciates in each of its uses,

4) A target vector of net outputs for the current period

Given this information, you can then apply either Kantorovich or the harmony method to construct a plan.

If you want a multi-year plan you need target vectors of net output for each succeeding year of the plan period.

I have a series of tutorial videos on this. The first:

explains how to do it using Kantrovich or linear programming. The second

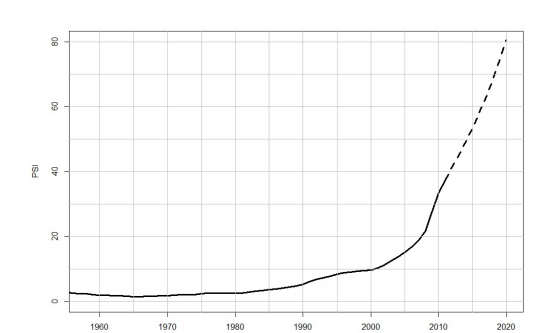

gives empirical demonstrations of the time complexity of using the Kantorovich approach. The third deals with the Harmony method and shows that for given sized problems it solves them much faster than the Kantorovich method.

By looking at how they are used in practice you will get a better grasp of the data that is required.