- We know that the share of wages in national income is relatively stable in the range 40% to 60%

- If follows from this that the share of surplus also is stable in this range.

- It also follows that the magnitude of surplus must be strongly correlated with the size over time of the workforce

- The rate of return is surplus/capitalstock =s/k

- It follows that the rate of return will only be stable if surplus and capital stock are growing at the same percentage rate, if capital stock grows faster the rate of return will decline.

- But by points 3 and 5 it follows that for the rate of return to be stable capital stock must grow at the same rate as the employed population, call growth of workforce g

- What then determines the rate of growth of capital stock?

- The accumulation of new fixed capital, call the share of accumulation out of surplus a

- The depreciation of existing fixed stock, call the depreciation rate d

- The rate of devaluation of existing fixed capital stock due to cheapening of the elements of fixed capital as labour productivity rises ( consider the historical cheapening of computers as an example ), call this t for the rate of technical progress

- We now derive a formula for the equilibrium rate of profit p’ p’=(g+t+d)/a

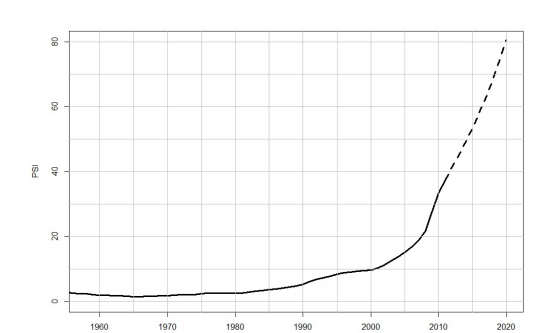

We can fit this to different countries and see that it predicts accurately the movement of profit rate a few years ahead

Solid line p’ dotted line actual rate of profit (s/k) for Canada, USA, Japan, Germany

Date: November 1, 2019

Author: Paul Cockshott

- We know that the share of wages in national income is relatively stable in the range 40% to 60%

- If follows from this that the share of surplus also is stable in this range.

- It also follows that the magnitude of surplus must be strongly correlated with the size over time of the workforce

- The rate of return is surplus/capitalstock =s/k

- It follows that the rate of return will only be stable if surplus and capital stock are growing at the same percentage rate, if capital stock grows faster the rate of return will decline.

- But by points 3 and 5 it follows that for the rate of return to be stable capital stock must grow at the same rate as the employed population, call growth of workforce g

- What then determines the rate of growth of capital stock?

- The accumulation of new fixed capital, call the share of accumulation out of surplus a

- The depreciation of existing fixed stock, call the depreciation rate d

- The rate of devaluation of existing fixed capital stock due to cheapening of the elements of fixed capital as labour productivity rises ( consider the historical cheapening of computers as an example ), call this t for the rate of technical progress

- We now derive a formula for the equilibrium rate of profit p’ p’=(g+t+d)/a

We can fit this to different countries and see that it predicts accurately the movement of profit rate a few years ahead